A major and effective way to do that is to move to a remote or hybrid work set-up. So to bill correctly, it’s important to identify what you’re charging for, the way you charge, and what adjustments you can make to improve your bottom line. As a contractor, you have flexibility, and you can terminate the contract at any time if either of you are dissatisfied with it.

How To Price Your Services Effectively

Once you’ve considered all the factors above, you’ll need to decide whether to charge an hourly rate or per project. On the other hand, if you offer more complex services, like tax preparation or strategic planning, you may want to charge a higher price. Also, consider the value you are providing for your clients. Typically, you’ll want to charge your more frequent clients at a lower rate because you’re seeing them more often and reviewing their books on a regular basis. For one-time clients, you may decide to charge more since you know they may not return and have last-minute requests and needs.

But if it’s more complex, like building out your financial outlook, you might be better off with hiring an accountant. As you’ve seen, there are several solutions to 3 ways to write a receipt this bookkeeping dilemma, but they also come with additional questions you should keep in mind before making a decision. To help you on this decision-making journey, we’ve gathered four questions to ask yourself before hiring a bookkeeper. But who wants the task of sifting through receipts and organizing statements when there’s a whole slew of business operations to attend to? It may be time for you to make the executive decision of hiring a bookkeeper to take the reins.

You’ll find that bookkeepers who have completed all 3 programs have a much higher average hourly wage. On paper, a part time bookkeeper may look like an attractive option. However, any error or oversight that may appear on the sheet is fully at your business’s expense. I tried using bill.com with this particular client, but I actually didn’t really find it as helpful as I would have hoped. I often just use the bill pay directly through the bank with this client, as it’s relatively easy to do, and many banks will do that service for free.

You may not know how long you’ll need someone, but comparing the monthly bookkeeping cost of a contractor versus an in-house employee is the best way to see this angle side by side. On the other hand, bookkeepers are the more affordable option. They require the least amount of education and focus on recording transactions, whereas an accountant or CPA spends their time analyzing financial data and generating financial statements. The professional services accounting software used can impact the price of the service. Maybe the freelancer is experienced in a single software and charges a lower rate for it. You can also find experts in numerous accounting software that charge more.

In an ideal world, all your clients would be ongoing at a fixed or value-based billing structure. They would know what services to expect from you, and you could charge an automatic, monthly fee. But the hourly rate is becoming outdated with the dominance of technology.

- 58% of accountants said updating technology has improved efficiency and productivity, which is vital for creating space to add the services that clients demand.

- In any industry, experience is influential in pricing decisions, and bookkeeping is no different.

- Business owners love Patriot’s award-winning payroll software.

- If they value your relationship and the service you provide, they’ll understand why you make occasional and reasonable increases.

How much should I charge for bookkeeping services? 6 Factors to consider

It means you set a fee for each service you offer and provide clients with a ‘menu’ of sorts, with corresponding prices. Becoming certified in your accounting software is a green light for business salon getinfo owners. They’ll be more inclined to pay higher fees if they see you’ve been endorsed by well-known software companies, especially if it’s the software that they use for their accounts.

Thoughts on hourly pricing.

On the other hand, if you’d like to use the time you spend bookkeeping focusing on other aspects of your business, then the cost of a bookkeeper may be worth it. Whether you opt for basic bookkeeping or full-service bookkeeping and accounting, either option can help you be better prepared come tax season. The number of tasks you assign to them directly impacts the price of each bookkeeping service.

ways to price your bookkeeping services

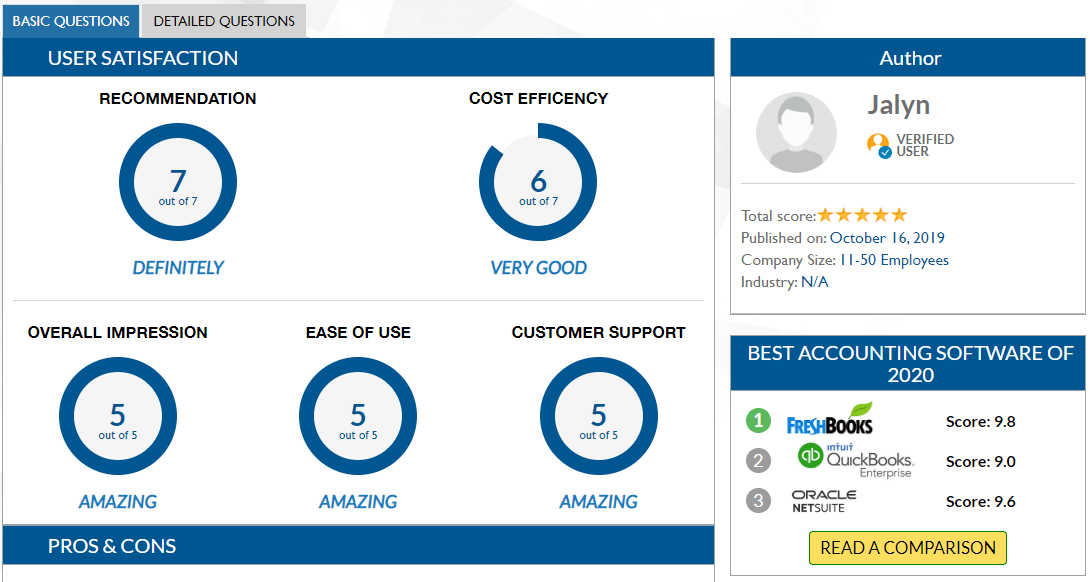

FreshBooks is an invoicing and accounting software for small businesses. Business owners who wish to automate their financial tasks can use some of the latest tools on the market. For example, if a firm decides to focus on value pricing, it may choose to sell its products at a higher price point than its competitors to make more profit. However, if the company instead chose to focus on cost, it might states with the lowest taxes and the highest taxes end up selling its products at a lower price point to save money.